"Up to Date" with current technologies and automated work processes

Payroll Accounting in the Cloud

Forward-looking companies advance the digitalization and switch to cloud solutions for payroll accounting. They help you get your work done securely, easily and quickly.

Save time on billing

Withholding tax rates are updated automatically. The payroll software helps you from calculation to automatic registration and deregistration.

Watch video

Easy to be compliant

The latest GAV or legal requirements in payroll accounting are updated automatically.

Watch video

Insights into your company

Comprehensive reporting for payroll accounting and human resources. Indexes can be fetched with a push of the button.

Watch video

No more manual input

Integration in any financial accounting. There is no need for manual data input in your accounting system.

Watch video

Never wait for updates again

A release with new features and customized customer requests is automatically imported every month.

Watch video

Get safety

Owing to backups performed every minute, you can restore your payroll data at any time.

Watch video

Reports and interfaces that are precisely tailored to the unique needs of your industry

Tailored to meet the needs of specific industries

This payroll accounting contains reports and interfaces that precisely tailored to the unique needs of the construction industry or public administrations.

The longer the more business applications are available online via the cloud. There are clear advantages,

but are cloud solutions always better? Below are the advantages and disadvantages of the two options.

In collaboration with Suva and Swissdec, the brand new KLE process was created

Report accidents digitally

The entire claims process can be digitized with KLE from A to Z and processed directly with the SwissSalary solution.

These companies and many others already work in the cloud

Use of SwissSalary 365

That is why companies rely on SwissSalary 365

«I would like to pay a big compliment to the entire SwissSalary team, especially Mr. Stefan Sempach and Ms. Mirjam Schweizer. Despite the short lead time, the launch on 1.1.2022 was perfectly structured and smoothly implemented. Your team is top-notch and a pleasure to work with! I've had the pleasure of introducing many salary programs in my many years of work, but I've never experienced anything of this quality. Many thanks to the whole team, as many other employees were involved, especially in the evaluation phase.»

Marianne Kamber, Personnel Administration Swissfluid AG

«We took a big step into the future with the adoption of SwissSalary. Online communication with offices and tax authorities simplifies the work, just like the use of SwissSalary Direct that allowed us to abandon payslip delivery in paper form. We look forward to seeing what the next step in the future looks like»

Marc Spring, Head of Human Resources, Schweizer Zucker AG

«In our fast-growing startup, we rely on SwissSalary 365 payroll service that completely ensures flexibility and reliability. SwissSalary is easy to use, and in addition to payroll processing, it will be used in the future for faultless absence management»

Tobias Klein, Chief of Staff SEBA Bank AG

«We have recently started using SwissSalary 365 and are absolutely delighted with the simplicity and user-friendliness of the software»

Kevin von Känel, Audi/SEAT Service Manager, Autohaus von Känel AG

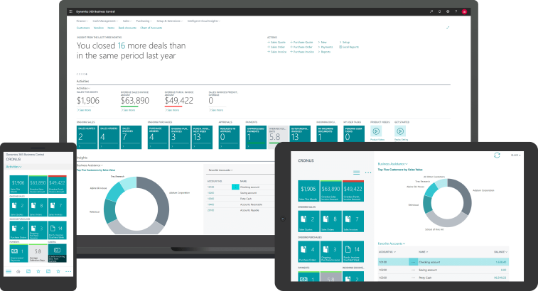

Do you know that you can use SwissSalary 365 as an app on your Smartphone or Tablet?

Microsoft Dynamics 365 Business Central App

Price calculation

Simple price calculation in the shortest time

Business Central - Accounting

Prices are based on the official Microsoft price list. For annual subscriptions, the total annual price is broken down into a monthly reference value on the quotation for better comparability.

However, billing is done annually on a pro rata basis.

For monthly licensing, Microsoft charges a surcharge of approximately 20% on top of the annual price. The official Microsoft price for the selected license model is always decisive.

Business Central - Essentials

SwissSalary is based on the powerful ERP solution ‘Dynamics 365 Business Central’. The ‘Essentials’ subscription provides you with a complete solution that in addition to enabling seamless integration of the SwissSalary payroll solution includes such core modules like Financial Management, Sales & Marketing, Project Management, Inventory Management and many other modules. Each Named User requires its own subscription. If you already use Business Central in your company, no additional subscriptions are required depending on your license and the number of existing users.

Business Central - Premium

The Premium subscription of Dynamics 365 Business Central extends the functionality of the Essentials subscription with the Service Management and Production modules. It makes the Premium version perfect for companies with demands in these domains. Please note that the Essentials and Premium subscriptions cannot be combined. If your company does not require Production or Service Management, the Essentials subscription will suffice.

Business Central - Team Member

The Team Member subscription is a cost-effective solution for users primarily with read access. It is perfect for positions like HR, CEO, CFO or others who want to view reports or use interfaces. Despite limited functions, the license allows easy use of Reports and Interfaces as well as limited editing in SwissSalary 365.

SwissSalary 365 - Basis

The Basic version of SwissSalary 365 provides access to the certified payroll accounting solution Swissdec plus with the comprehensive functions listed below:

| SwissSalary 365 Module Description | Basis | Plus |

|---|---|---|

| Employee card | ||

| Comprehensive Employee card for personnel data input | X | |

| Personnel data input using timeline (TimeMachine) | X | |

| Structuring of permissions into categories of clients and persons (Allocation Group) as well as department head restrictions | X | |

| Employee templates for quick input of new employees | X | |

| Automatic years-of-service calculation according to company-specific templates | X | |

| Automatic calculation of the 13th/14th monthly salary provision/disbursement, holiday pay and holiday remuneration, incl. automatic recognition of age-related and years-of-service levels | X | |

| Pay rise procedure with detailed assessments | X | |

| Unlimited number of personnel bank addresses, including wage assignment (debt collection, debt enforcement, etc.), third-party payments, QR codes, payments in foreign currencies, the latest standard ISO 2022 | X | |

| Automated Income tax calculation according to the 2021 Income Tax Regulation, including extrapolation for recruitments and resignations during the month, concurrent employments. Income tax rates throughout Switzerland. Monthly and yearly calculation modes. Timeline calculations (TimeMachine) | X | |

| Test payslips can be directly retrieved from the Employee card & Allocated salary | X | |

| Flexible information register for extensive company-specific statistics | X | |

| Various salary and absence statistics | X | |

| Human resources for managing alternative addresses, pieces of equipment, qualification matrix, etc. | X | |

| Data integrity validations | X | |

| Employee copy function (across clients) | X | |

| Personnel file for importing and storing personalized documents, including restricted access for department heads. Transfer of documents directly to the SwissSalary Direct Employee Portal. | X | |

| Create form letters and save directly to personnel file | X | |

| Create accident, illness and supplementary accident claim reports directly in the Employee card and deliver them to insurers (KLE) | X | |

| Payroll Setup | Basis | Plus |

| Flexible setup options in the areas of AHV/IV/EO, family allowances, UVG, KTG, UVGZ, BVG, Income tax and various cantonal funds | X | |

| Automated calculation of BVG employee and employer contributions (storing of multiple BVG plans) | X | |

| Gross/net calculation of wage items via iteration (bonus, etc.) | X | |

| Net wage compensation calculation (via iteration) for daily allowances | X | |

| Integrated posting logic in FIBU, cost accounting and projects | X | |

| Automated pro rata calculation at resignation of vacation and overtime credit balances | X | |

| Integration in SAP Business ByDesign (personnel and absence data, posting) | X | |

| More than ten standardized FIBU export interfaces to well-known ERP providers such as Dynamics 365 Finance, Abacus, SAP, Infoniqa 50/200, JD Edwards, IFS, etc. | X | |

| Automated pro rata calculation of monthly provisions for holidays and overtime in financial accounting | X | |

| Salary Types | Basis | Plus |

| Default Salary Types available in 6 languages after initialization | X | |

| Direct link to the FIBU chart of accounts, dimensions, etc. stored in Business Central. | X | |

| More complex posting logic using posting category allocation | X | |

| Resulting wage type technology (calculation logic for complex GAV specifications for bonuses and allowances, etc.) | X | |

| UVG and KTG daily allowance approach calculation for data transfer via KLE, UKA, Sunet plus or internal calculation, etc. | X | |

| Automatic reductions and calculations of wage items in case of recruitments/resignations during the month | X | |

| Absences: automatic hours to days conversion with a single salary type | X | |

| Customizable salary types, including plausibility check (copy function available) | X | |

| Automatic translation of salary types for payslip | X | |

| Varied handling of monthly/hourly wages in the area of the 13th/14th monthly salary, bonuses with regard to GAV specifications | X | |

| Data input | Basis | Plus |

| Daily, weekly or monthly data input (hours worked, allowances, expenses, etc.) in various clearly arranged input screen | X | |

| Test payslip per employee is possible at any time | X | |

| Registration journal with Excel import of data | X | |

| Data integration from third-party systems via open data import interface | X | |

| Accounting Procedures | Basis | Plus |

| Varied payroll processing is possible (down-payment, monthly and multiple payments per month) | X | |

| Exact net/gross calculation and net wage compensation via iteration | X | |

| Input of data into timeline via TapBoard | X | |

| Analysis options | Basis | Plus |

| Standardized assessments according to the latest Swissdec standard | X | |

| Personal wage account for revision | X | |

| Assessments for the whole absence management, incl. automatic data transfer into Excel | X | |

| Assessments with selectable column settings and automatic transfer into Excel for master and transaction data | X | |

| Automatic creation of Word form letters, optionally for categories of persons | X | |

| Salary certificate | Basis | Plus |

| Many additional assessments like Logib, Landolt & Mächler wage comparison, etc. | X | |

| Cross-client personnel lists | X | |

| Absence report per employee | X | |

| ALV employer certificates and Certificate of Interim Earnings ALV | X | |

| Automatic ALV bad weather and temporary unemployment statements | X | |

| Fully integrated, flexible work calendar per personnel group or employee with automatic calculation of over- and undertime according to company-specific or GAV regulations | X | |

| UKA interface (workforce and absence data, incl. daily allowance import) | X | |

| Sunet plus Interface | X | |

| KLE process for reporting UVG, KTG and UVGZ claims (Swissdec 5.0) | X | |

| Miscellaneous | Basis | Plus |

| Latest Swissdec certification 5.0 (swissdec certified plus) | X | |

| ELM submission 5.0 | X | |

| Microsoft Copilot directly integrated in the solution for AI queries | X | |

| Pivot queries (similar to Microsoft Excel) | X | |

| Integration with Microsoft solutions like Teams, Excel, Word, OneDrive, etc. | X | |

| Swissdec certification of KLE 1.0 (claim reports for UVG, UVGZ and KTG) | X | |

| Creation of accident/illness reports by employees directly via SwissSalary Direct with automatic import into SwissSalary | X | |

| Bi-directional interfaces to the add-ons SwissSalary Direct and SwissSalary EasyRapport | X | |

| Integrated interface to SwissSalary Insights (for SaaS cloud customers only) | X | |

| Automatic provisions for absences (holidays, overtime, etc.) | X | |

| Many standardized interfaces to third-party systems PEKA, SwissPension, etc. | X | |

| Simple release tool to ensure update to the latest version | X |

Other SwissSalary apps available in the SaaS cloud solution include

- SwissSalary Banking | Bank payment transmission directly to financial institutions

- SwissSalary Cloud Connector | Connector between the onPremise and SaaS cloud solution

- SwissSalary Cloud Essentials | Cross-client queries, assessments, organization charts

SwissSalary 365 - Plus

The Basic version of SwissSalary 365 provides access to the certified payroll accounting solution Swissdec plus with the comprehensive functions listed below:

| SwissSalary 365 Module Description | Basis | Plus |

|---|---|---|

| Employee card | ||

| Comprehensive Employee card for personnel data input | X | |

| Personnel data input using timeline (TimeMachine) | X | |

| Structuring of permissions into categories of clients and persons (Allocation Group) as well as department head restrictions | X | |

| Employee templates for quick input of new employees | X | |

| Automatic years-of-service calculation according to company-specific templates | X | |

| Automatic calculation of the 13th/14th monthly salary provision/disbursement, holiday pay and holiday remuneration, incl. automatic recognition of age-related and years-of-service levels | X | |

| Pay rise procedure with detailed assessments | X | |

| Unlimited number of personnel bank addresses, including wage assignment (debt collection, debt enforcement, etc.), third-party payments, QR codes, payments in foreign currencies, the latest standard ISO 2022 | X | |

| Automated Income tax calculation according to the 2021 Income Tax Regulation, including extrapolation for recruitments and resignations during the month, concurrent employments. Income tax rates throughout Switzerland. Monthly and yearly calculation modes. Timeline calculations (TimeMachine) | X | |

| Test payslips can be directly retrieved from the Employee card & Allocated salary | X | |

| Flexible information register for extensive company-specific statistics | X | |

| Various salary and absence statistics | X | |

| Human resources for managing alternative addresses, pieces of equipment, qualification matrix, etc. | X | |

| Data integrity validations | X | |

| Employee copy function (across clients) | X | |

| Personnel file for importing and storing personalized documents, including restricted access for department heads. Transfer of documents directly to the SwissSalary Direct Employee Portal. | X | |

| Create form letters and save directly to personnel file | X | |

| Create accident, illness and supplementary accident claim reports directly in the Employee card and deliver them to insurers (KLE) | X | |

| Payroll Setup | Basis | Plus |

| Flexible setup options in the areas of AHV/IV/EO, family allowances, UVG, KTG, UVGZ, BVG, Income tax and various cantonal funds | X | |

| Automated calculation of BVG employee and employer contributions (storing of multiple BVG plans) | X | |

| Gross/net calculation of wage items via iteration (bonus, etc.) | X | |

| Net wage compensation calculation (via iteration) for daily allowances | X | |

| Integrated posting logic in FIBU, cost accounting and projects | X | |

| Automated pro rata calculation at resignation of vacation and overtime credit balances | X | |

| Integration in SAP Business ByDesign (personnel and absence data, posting) | X | |

| More than ten standardized FIBU export interfaces to well-known ERP providers such as Dynamics 365 Finance, Abacus, SAP, Infoniqa 50/200, JD Edwards, IFS, etc. | X | |

| Automated pro rata calculation of monthly provisions for holidays and overtime in financial accounting | X | |

| Salary Types | Basis | Plus |

| Default Salary Types available in 6 languages after initialization | X | |

| Direct link to the FIBU chart of accounts, dimensions, etc. stored in Business Central. | X | |

| More complex posting logic using posting category allocation | X | |

| Resulting wage type technology (calculation logic for complex GAV specifications for bonuses and allowances, etc.) | X | |

| UVG and KTG daily allowance approach calculation for data transfer via KLE, UKA, Sunet plus or internal calculation, etc. | X | |

| Automatic reductions and calculations of wage items in case of recruitments/resignations during the month | X | |

| Absences: automatic hours to days conversion with a single salary type | X | |

| Customizable salary types, including plausibility check (copy function available) | X | |

| Automatic translation of salary types for payslip | X | |

| Varied handling of monthly/hourly wages in the area of the 13th/14th monthly salary, bonuses with regard to GAV specifications | X | |

| Data input | Basis | Plus |

| Daily, weekly or monthly data input (hours worked, allowances, expenses, etc.) in various clearly arranged input screen | X | |

| Test payslip per employee is possible at any time | X | |

| Registration journal with Excel import of data | X | |

| Data integration from third-party systems via open data import interface | X | |

| Accounting Procedures | Basis | Plus |

| Varied payroll processing is possible (down-payment, monthly and multiple payments per month) | X | |

| Exact net/gross calculation and net wage compensation via iteration | X | |

| Input of data into timeline via TapBoard | X | |

| Analysis options | Basis | Plus |

| Standardized assessments according to the latest Swissdec standard | X | |

| Personal wage account for revision | X | |

| Assessments for the whole absence management, incl. automatic data transfer into Excel | X | |

| Assessments with selectable column settings and automatic transfer into Excel for master and transaction data | X | |

| Automatic creation of Word form letters, optionally for categories of persons | X | |

| Salary certificate | Basis | Plus |

| Many additional assessments like Logib, Landolt & Mächler wage comparison, etc. | X | |

| Cross-client personnel lists | X | |

| Absence report per employee | X | |

| ALV employer certificates and Certificate of Interim Earnings ALV | X | |

| Automatic ALV bad weather and temporary unemployment statements | X | |

| Fully integrated, flexible work calendar per personnel group or employee with automatic calculation of over- and undertime according to company-specific or GAV regulations | X | |

| UKA interface (workforce and absence data, incl. daily allowance import) | X | |

| Sunet plus Interface | X | |

| KLE process for reporting UVG, KTG and UVGZ claims (Swissdec 5.0) | X | |

| Miscellaneous | Basis | Plus |

| Latest Swissdec certification 5.0 (swissdec certified plus) | X | |

| ELM submission 5.0 | X | |

| Microsoft Copilot directly integrated in the solution for AI queries | X | |

| Pivot queries (similar to Microsoft Excel) | X | |

| Integration with Microsoft solutions like Teams, Excel, Word, OneDrive, etc. | X | |

| Swissdec certification of KLE 1.0 (claim reports for UVG, UVGZ and KTG) | X | |

| Creation of accident/illness reports by employees directly via SwissSalary Direct with automatic import into SwissSalary | X | |

| Bi-directional interfaces to the add-ons SwissSalary Direct and SwissSalary EasyRapport | X | |

| Integrated interface to SwissSalary Insights (for SaaS cloud customers only) | X | |

| Automatic provisions for absences (holidays, overtime, etc.) | X | |

| Many standardized interfaces to third-party systems PEKA, SwissPension, etc. | X | |

| Simple release tool to ensure update to the latest version | X |

Other SwissSalary apps available in the SaaS cloud solution include

- SwissSalary Banking | Bank payment transmission directly to financial institutions

- SwissSalary Cloud Connector | Connector between the onPremise and SaaS cloud solution

- SwissSalary Cloud Essentials | Cross-client queries, assessments, organization charts

SwissSalary 365 - Budget

The Budget module of SwissSalary 365 is a practical extension of the Basic or Plus version. This module allows you to create various wage budgets, carry out evaluations in Excel and transfer data directly to the Business Central FIBU budget module. In addition, you have the option of creating evaluations of previous costs and calculating in-depth forecasts for future wage costs. With this, you get comprehensive and precise planning assistance for your personnel budget.

SwissSalary Insights

SwissSalary Insights is a web-based cloud service exclusively available to SwissSalary 365 customers (SaaS cloud). This solution allows you to display current company data simply and clearly and gain valuable insights with just a few clicks. Data-driven insights offer a clear visualization of key figures and trends so that you can quickly make informed decisions.

The basic fee for SwissSalary Insights is CHF 35. In addition, a fee of CHF 0.55 per active employee is charged, which varies monthly depending on the number of employees.

Device-independent data visualization provides access to the latest data at any time - whether in the office, at home or on the go. This way, you always have an overview and can efficiently compare and evaluate data.

SwissSalary EasyRapport

SwissSalary EasyRapport is the web-based time and performance recording solution with a bidirectional interface. It enables you to import relevant personnel data and dimensions such as cost centres, cost objects or projects from SwissSalary with a button click. Time data, absences and expenses can be recorded from just CHF 105/month (base cost and 1 user), which significantly reduces administrative effort in your payroll accounting.

Thanks to the device-independent solution, employees can easily record their hours worked, expenses and absences both in the office and on the go. Optimized interplay of time recording and payroll accounting helps minimize administrative effort and optimize workflow. Thanks to the device-independent solution, employees can easily record their hours worked, expenses and absences in the office or on the go. Optimized interaction of time recording and payroll accounting minimizes administrative effort and optimizes the workflow.

Pricing:

Up to 50 employees: CHF 5.-/month per employee

51 up to 100 employees: CHF 3.-/month per employee

101 up to 400 employees: CHF 2.-/month per employee

401 employees and above: CHF 1.-/month per employee

Calculation example for 132 employees:

Base fee: CHF 100.-

50 employees x CHF 5.- = CHF 250,-

50 employees x CHF 3.- = CHF 150,-

32 employees x CHF 2.- = CHF 64,-

Total: CHF 564.-

This pricing allows for flexible adjustment to the size and needs of the company.

Function overview

- Recording of working hours on projects, cost centers or cost units

- Recording of absences (illness, accident, military service, vacation, paid/unpaid absences, etc.)

- Recording of various expenses (various VAT rates)

- Time recording with unlimited come/go entries

- Time recording with stamp function (time stamp from the server)

- Definition of limit values (upper/lower limits, incl. rounding and target time)

- Different working time calendars

- Monthly, weekly and daily view

- Simple recording over a desired period (pulling)

- Recording of supplementary texts (e.g. paid absences)

- Access to the past months/years

- Employee approval

- Approval of cost centers/project

- Quick approval per employee, line or entry

- Independent determination of deputies during absences

- Option to mutate the collected data

- Holiday planning and absence analysis

- Instant holiday balance, overtime balance, etc.

- Team monitoring: absence view for the entire work team

- Project monitoring with planned values and vacant periods

- Reporting and checklists are evaluable in PDF, Excel or CSV format

- Employee lists incl. phone numbers and addresses

- Employee absence levels

- Full integration into SwissSalary payroll accounting system

- Simple authentication (login can be reset by user)

- Option to set an administrator per client

- Multilingual support

SwissSalary Direct

SwissSalary Direct is a modern employee portal solution for simple and secure provision of payslips, wage statements and other personalized documents. Employees are informed in due time via email about new documents and can conveniently view, save or print them online. You and your employees can benefit from the advantages of this digital service starting from just CHF 10.00/month. The fees are calculated quarterly based on the number of active employees and the selected subscription (Basic, Plus or Advanced).

Prezzi:

Pricing: Minimum amount of CHF 10.-/month

Bills are issued quarterly, based on active, registered employees.

An additional amount is charged per employee/month depending on the license:

Basic: CHF 0.50

Plus: CHF 0.75

Advanced: CHF 1.00

Activation and use:

To use SwissSalary Direct, your employees must register once. They will receive a personal registration code stated on their (paper copy) payslip. After registration, your employees have immediate access to all functions of the selected package. SwissSalary Direct is a web-based solution that does not need to be installed and can be used with all popular Internet browsers.

Functions overview:

Basic: Employees have the option of viewing, saving and printing payslips, wage statements and other documents.

Plus: In addition to the Basic functionality, employees can change their personal address or bank details, which are sent to payroll accounting for verification. Security is increased with two-factor authentication (Authenticator app).

Advanced: Using this package, your employees can send documents like medical certificates directly to the HR department. In addition, accident and damage reports are sent digitally to payroll accounting thanks to full KLE integration. Here, too, security is increased with two-factor authentication and SMS codes as a fallback.

SwissSalary Direct offers maximum security for sensitive data. All transfers are encrypted and the data is stored in one of the most secure Tier 4 data centres in Switzerland. The system is available in six languages (German, French, Italian, English, Spanish, Portuguese) and provides simple and efficient management of payroll and personnel documents.

SwissSalary Direct helps you relieve your payroll department of administrative tasks like printing, envelope inserting and document franking, since all documents are provided directly and securely via the Portal.

SwissSalary Banking App

Banking Core

Pay purchase invoices and reconcile your transactions without opening your e-banking.

This app allows you to create payments for purchase invoices and reconcile your bank accounts without opening your e-banking. Grant the app access to one or several of your bank accounts of a supported financial institution and pay the payroll with just a few clicks.

SwissSalary Banking

Pay your SwissSalary 365 payroll directly in Microsoft Dynamics 365 Business Central.

This app allows you to create payments for a processed payroll without opening your e-banking. Grant the app access to one or several of your bank accounts of a supported financial institution and pay the payroll with just a few clicks.

Banking for Finance

Pay purchase invoices and reconcile your transactions without opening your e-banking.

This app allows you to create payments for purchase invoices and reconcile your bank accounts without opening your e-banking. Grant the app access to one or several of your bank accounts of a supported financial institution and pay the payroll with just a few clicks.

SwissSalary Cloud Essentials App

SwissSalary Cloud Essentials

Essential features to enhance the SwissSalary experience in the cloud.

This app builds on top of the core SwissSalary 365 app by adding new features that can only be made possible using the newest tools from the Microsoft Dynamics 365 Business Central platform. With over 20 years of experience, SwissSalary is the solution to support you with processing fast and reliable payroll runs.

SwissSalary Cloud Connector App

Cloud Connector

Establish a one-time or permanent connection from the cloud to your on-premises ERP solution.

The Cloud Connector enables users to set up a hybrid environment where any entity in Microsoft Dynamics 365 Business Central or NAV can be selected and synchronized between an on-premises instance and a cloud instance. With the Cloud Connector, customers who are not yet ready to move all of their ERP system to the cloud can choose to move a part of it to the cloud while keeping any necessary data in-sync with the on-premises environment.

SwissSalary Cloud Connector

Additional Cloud Connector features for customers using SwissSalary 365. This app gives additional integration with the SwissSalary Payroll module. For example, configure your Payroll Setup to enable automatic synchronization of journal lines to the on-premises environment before posting them in the cloud.

SwissSalary Demo

Interested?

Begin your payroll journey today!

Curious to find out how SwissSalary can simplify your daily work routine? Our demo video shows you the most important features and benefits of our solution—compact, easy to understand, and practical.

Watch demo video

Get exclusive access to the demo video—just enter your name and email address and get started right away.